Emerging market responses to Federal Reserve moves

Emerging market responses to Federal Reserve moves significantly impact their economies, influencing investments, currency fluctuations, and overall growth strategies as these nations adapt to global monetary policy changes.

Emerging market responses to Federal Reserve moves are increasingly complex and can affect economies worldwide. Have you considered how these shifts influence your investment strategies? Let’s take a closer look.

Impact of Federal Reserve decisions on emerging markets

The impact of Federal Reserve decisions on emerging markets is significant and multifaceted. As the Fed adjusts interest rates, emerging economies often face various challenges and opportunities. Understanding these impacts can help investors navigate global financial waters.

Market Reactions

When the Federal Reserve raises interest rates, emerging markets can experience capital flight, as investors move their money to perceived safer assets. This usually leads to depreciation in local currencies. However, not all emerging markets react the same way. Some may benefit from a strengthening dollar and increased export competitiveness.

Key Effects on Economies

- Increased borrowing costs for businesses

- Reduced consumer spending due to higher financial stress

- Impacts on trade balances as currency value fluctuates

- Potential for inflationary pressures in certain regions

The credit environment can change dramatically as the Fed tightens or loosens its policy, influencing how banks operate. Stronger currencies may attract foreign investment, boosting local markets. Conversely, a weak performance can strain government budgets, limiting public spending.

Economic interdependence also plays a role. Countries with higher trade volumes with the U.S. often feel the ripples of Fed decisions more acutely. Emerging markets must stay proactive in adapting to these financial shifts.

Moreover, geopolitical factors can complicate the picture, as political stability or instability in an emerging market may amplify or mitigate the effects of U.S. monetary policy. Investors should closely monitor such developments to make informed decisions.

As we navigate through these dynamics, it’s crucial to keep an eye on the changing landscape of emerging markets. By doing so, we can better understand future trends and prepare for potential adjustments in investment strategies.

How investments react to Fed rate changes

Understanding how investments react to Fed rate changes is crucial for investors. When the Federal Reserve adjusts interest rates, various asset classes respond differently. These changes can influence investment decisions significantly, leading to varying outcomes.

Direct Effects on Asset Classes

Typically, when the Fed raises rates, the cost of borrowing increases. This can lead to lower corporate profits and squeeze consumer spending. Consequently, equity markets often experience volatility. However, some sectors may benefit, such as financial institutions that profit from higher loan rates.

Investment Strategies During Rate Changes

- Investors may shift to fixed income securities, seeking higher yields.

- Equities can become more volatile, prompting a search for stability.

- Diversification becomes crucial as different sectors react differently to rate changes.

- Commodities may also fluctuate, particularly if rates impact inflation expectations.

On the other hand, the reaction of bonds can be quite pronounced. When rates go up, bond prices typically fall. This can lead to losses for those holding existing bonds. Understanding the inverse relationship between interest rates and bond prices helps in making informed decisions.

Moreover, international investments can also feel the aftershocks of Fed decisions. For instance, stronger U.S. rates can lead to a stronger dollar, making foreign investments more expensive. This could potentially slow capital inflow into emerging markets, which are sensitive to dollar fluctuations.

Ultimately, adapting investment strategies in response to Fed rate changes requires keen awareness of the broader financial landscape. Keeping a close watch on how different asset classes react can empower investors to make timely decisions.

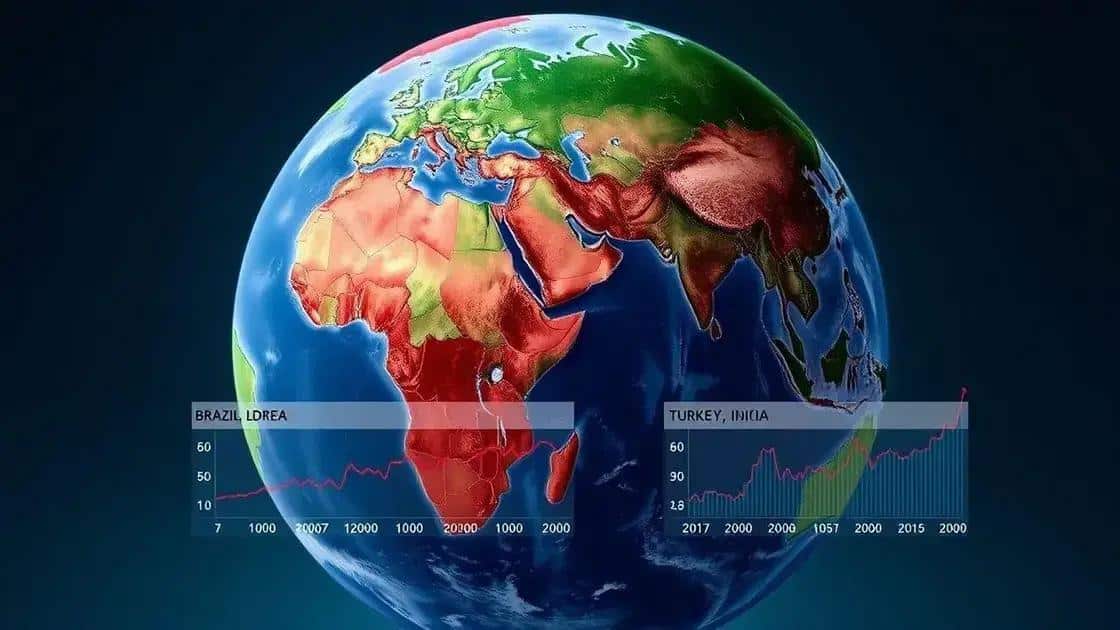

Case studies of specific emerging economies

Exploring **case studies of specific emerging economies** provides valuable insights into how these nations navigate external financial pressures. Each country reacts differently to the influences of the Federal Reserve, showcasing diverse economic strategies and outcomes.

Brazil: A Balancing Act

Brazil’s economy often finds itself impacted by U.S. rate changes due to its commodity exports. When the Fed raises interest rates, the Brazilian real may weaken, making exports cheaper but increasing the cost of foreign debt. This push and pull can lead to inflationary pressures.

India: Resilient Growth

India demonstrates resilience, with a diverse economy that supports its recovery from Fed policies. The Indian government can implement monetary policies to maintain growth even when foreign investment declines. This adaptability puts India in a stronger position to mitigate the impacts of U.S. financial decisions.

Turkey: Currency Instabilities

For Turkey, fluctuations in the Federal Reserve’s rates can create significant currency instability. A weak lira often prompts rapid inflation, which forces the government to adapt its financial strategies quickly. Investors watch Turkey closely, as political and economic factors combine to shape its market responses.

Comparative Insights

- Brazil often relies on commodity exports for economic stability.

- India’s policies promote flexibility in adapting to changing investments.

- Turkey’s market reacts sharply to currency fluctuations influenced by foreign monetary policy.

By examining these case studies, investors and policymakers can gain a deeper understanding of the challenges and strategies employed by different emerging economies. Each case reveals unique journeys shaped by both domestic and international influences, emphasizing the need for an adaptable approach in the face of global financial shifts.

Trends in currency fluctuations

Understanding the trends in currency fluctuations is essential in today’s interconnected global economy. Currency movements can be influenced by various factors, including interest rates set by the Federal Reserve and overall market sentiment.

Effects of Federal Reserve Policies

When the Fed changes interest rates, it can cause immediate fluctuations in currency values. For example, a rate hike typically strengthens the U.S. dollar as higher interest rates attract foreign capital. Emerging markets often experience a depreciation of their currencies as investors shift their focus to U.S. assets.

Market Reactions

- Increased volatility in foreign exchange markets.

- Shifts in trading patterns among currency pairs.

- Heightened risk for investors dealing in emerging market currencies.

The increasing strength of the dollar can also impact global trade. Countries that rely heavily on exports may find their goods becoming more expensive for foreign buyers, which can dampen demand. This can lead to trade imbalances and affect economic growth in various regions.

Conversely, a weaker dollar can make U.S. exports cheaper, potentially boosting export-driven sectors. However, fluctuations can also lead to uncertainty, making it challenging for businesses to plan effectively. Companies may hedge their currency risks to secure a favorable exchange rate.

In addition to economic factors, geopolitical events can exacerbate currency fluctuations. Political instability in one region can lead to rapid currency depreciation, while elections or policy announcements can create market excitement, leading to short-term gains or losses. Monitoring these trends is vital for investors looking to optimize their portfolios.

Future predictions for emerging market dynamics

Looking ahead, the future predictions for emerging market dynamics reveal a landscape shaped by both challenges and opportunities. As global economic conditions change, these markets must adapt to maintain growth and stability.

Technological Advancements

Emerging markets are increasingly investing in technology to boost productivity and competitiveness. This shift towards digitalization can help countries leapfrog traditional stages of development. Innovations in fintech, healthcare, and renewable energy are becoming vital for sustainable growth.

Changing Demographics

- Young and growing populations offer potential for a dynamic workforce.

- Urbanization trends will increase demand for infrastructure and services.

- Education and skill development in these regions will be key to harnessing this potential.

While the outlook is promising, emerging economies must also confront several risks. External factors such as trade tensions, geopolitical instability, and climate change can significantly impact growth. A country’s ability to navigate these challenges may define its success in the coming years.

Moreover, the economic policies of developed nations, particularly the U.S. Federal Reserve, will continue to affect capital flows into emerging markets. As rates change, investors may become more selective, focusing on countries that demonstrate resilience. Thus, policymakers in these regions need to create favorable environments to attract and retain foreign investment.

Finally, diversification of trade relationships is essential. Emerging economies that can establish strong ties with multiple partners may fare better in a fluctuating global market. By leveraging regional trade agreements, these countries can bolster their economic positions against future uncertainties.

FAQ – Frequently Asked Questions about Emerging Market Dynamics

How do Federal Reserve rate changes impact emerging markets?

Rate changes can lead to currency fluctuations and affect capital flows, which can create both challenges and opportunities for emerging markets.

What role does technology play in emerging market growth?

Technology boosts productivity and competitiveness, allowing emerging economies to leapfrog traditional stages of development.

Why are geopolitical factors important for emerging markets?

Geopolitical stability can influence investor confidence, making it crucial for these markets to maintain strong political environments.

What strategies can emerging markets use to attract investments?

Implementing favorable policies and diversifying trade relationships can help attract foreign investments and drive economic growth.